Table Of Content

Medical coverage is secondary, meaning you’ll have to file medical claims with your health insurance provider first, but you have the option to upgrade to primary coverage. Not all travel insurance policies provide top-notch coverage for cruises, so we evaluated 37 travel insurance policies with missed connection coverage to find the best cruise insurance. We scored policies based on cost, trip cancellation, trip interruption and medical expense benefits. Some premium credit cards offer valuable travel protections comparable to what you might get from a standard travel insurance plan. A common question we receive is "how late can I purchase my travel insurance?" We recommend purchasing early, ideally after making your first payment towards your trip.

Why Should You Consider Buying Cruise Insurance?

Help! I Missed a Cruise and the Cruise Line's Own Travel Insurance Won't Pay. - The New York Times

Help! I Missed a Cruise and the Cruise Line's Own Travel Insurance Won't Pay..

Posted: Thu, 01 Feb 2024 08:00:00 GMT [source]

This covers the cost of emergency medical transportation to the nearest facility that can provide adequate care for your illness or injury. Travel medical insurance covers the cost of non-routine health care if you get sick, including contracting COVID-19, or being injured on your trip, up to your policy limit. This optional upgrade can increase the cost of your policy by 40% to 90%. It gives you increased flexibility with your travel plans, but only up to a point.

Will a cruise travel insurance plan cover my flights?

This service could come in handy if you're stopping at a variety of unfamiliar destinations during your cruise. The CFAR coverage is available as an upgrade on Travel Guard's Preferred and Deluxe plans. If you don't need this optional upgrade, you could save money on your premium with Travel Guard's Essential plan. No coverage for pre-existing conditions that fall within 90 days of your policy's start date. No coverage for pre-existing conditions that fall within 60 days of your policy's start date.

Best Cruise Insurance Plans

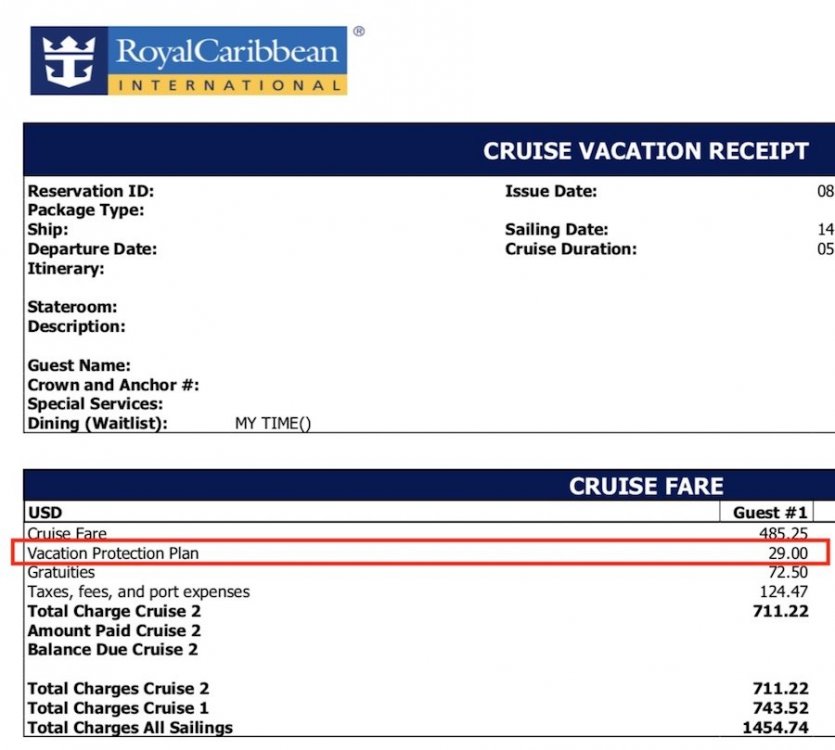

You may have been offered travel insurance from travel suppliers such as cruise lines and airlines. To get the best coverage for your cruise vacation, it’s usually best to compare and buy travel insurance from a third-party insurance company rather than the travel supplier itself. Before buying this coverage, compare your options against your credit card benefits. You might also shop for general travel insurance policies to see if you can get a better deal than what’s offered through your cruise line. If you already have a standalone travel insurance policy or a credit card with travel protections, you may wonder if you need to purchase a cruise travel insurance policy. Cruise travel insurance is a type of insurance that protects you while you are on a cruise.

The Seven Corners Trip Protection Basic policy offers trip cancellation and interruption, medical coverage, and medical evacuation, along with COVID-19 cancellation and medical coverage. All of these contingencies and more can be covered; it's just a matter of finding the best insurance policy for you. Here's how to evaluate which plan is the right choice for you, as well as five of the best cruise travel insurance plans available.

Does the Travel Insurance Provided by my Credit Card Cover My Cruise?

The first thing to know is that your insurance policy only protects you; if you want the rest of your family or travel companions to have the same protection, then they must be added to your policy (or take out their own). The one exception is that some policies cover children under 17 traveling with an insured guardian at no additional charge. Two months before embarkation, your travel partner loses his job and can no longer afford to go on vacation. Without insurance, you may be left holding the bag to either pay an additional single supplement to continue with your plans, or to cancel and get hit with the full force of the cruise line's cancellation policy.

Under normal circumstances, you don't need to purchase a so-called "cancel for any reason" add-on to your cruise travel insurance policy unless you really need the flexibility. Also, financial default may not be a covered event in a cruise line-sold policy, but it's typically covered with plans from third-party travel insurance companies. But perhaps most importantly, many travel insurance policies will cover medical expenses you incur while on a cruise. Some will even cover the cost of evacuating from a foreign destination if you are in the midst of a medical crisis. If you should unexpectedly fall ill or become injured while you're on your cruise, you'll need some sort of medical insurance coverage to offset the expense of the care you receive. Many cruisers don't know that their home medical insurance provider may not cover any care they receive outside of their home country and some may only cover a portion of the costs.

Airline Accident Coverage

Is travel insurance worth it? - CNBC

Is travel insurance worth it?.

Posted: Tue, 09 Apr 2024 07:00:00 GMT [source]

It also offers coverage for COVID-19 medical and cancellation, trip cancellation and interruption, and medical expenses and evacuation with primary coverage. Travel insurance covers the non-refundable portion of your trip, so you don’t lose the investment in your cruise vacation if you have a covered reason to cancel your trip. Cruise trip insurance also covers medical expenses, medical evacuation costs, baggage, and trip interruption costs. This type of insurance is a smart way to protect the investment in your cruise trip and will only cost a small percentage of your total trip cost. Coverage for preexisting medical conditions in cruise travel insurance refers to the extent that an insurance policy covers medical expenses related to a medical condition that the insured had prior to purchasing the policy. The Chase Sapphire Reserve card, for example, offers trip delay reimbursement, trip cancellation and interruption insurance, emergency medical coverage and even medical evacuation coverage, among other benefits.

For example, if you have secondary insurance and someone steals your camera from your bag in St. Mark's Square, you'll need to try to collect on your homeowner's or renter's policy first. A standalone emergency evacuation policy is a good choice if you don't plan on getting other insurance but still want coverage for a medical emergency. While evacuation/repatriation is generally included in top-of-the-line policies, you may also purchase more comprehensive, standalone evacuation policies from companies like MedJetAssist. While cruise ships have medical facilities, they're usually not equipped to treat serious illnesses.

IMG’s iTravelInsured Travel Lite, with options for winter, adventure, and extreme sports, can give you the coverage you need. We were quoted $58.87 for a 40-year-old traveler cruising to Costa Rica with plans to zipline. It covers trip cancellation and interruption, medical expenses, medical evacuation, and adventure sports with some exclusions, such as diving and adventure races. Compare the trip insurance that’s included with your credit card with standalone travel insurance policies. Standalone policies tend to be more comprehensive and offer more coverage.

Most travel insurance excludes pre-existing conditions from coverage unless you meet certain conditions and qualify for a waiver. A pre-existing medical conditions exclusion waiver allows your emergency medical expense coverage to pay for treatment related to conditions you’ve been treated for in the months leading up to your trip. Our insurance experts reviewed 40 aspects of 37 travel insurance plans to find the best cruise insurance.

Some vacationers must return to land by medical evacuation, whether by helicopter directly from the ship or by plane from a port. This service costs tens of thousands of dollars, and your regular health insurance generally won’t cover this. The cost of cruise insurance varies depending on several factors, including your age, destination, length of cruise, trip cost and the time left before your departure date. Different insurance providers will also have their own underwriting criteria, which leads to varying prices for a single trip.

No comments:

Post a Comment