Table of Content

Talk to a Home Loan Expert At Citadel, we believe that applying for a mortgage, buying a home or refinancing should be easy and convenient. Purchase a Home Get the information you need to buy a home. First-Time Home Buyer Our first-time homebuyer option is smart for new buyers, with a low down payment requirement and assistance throughout the process. Citadel Mortgages At Citadel, we offer a quick, easy and secure mortgage process and products that are tailored to your needs. Adjustable Rate Mortgage Our Adjustable Rate Mortgage has a lower principal and interest payment the first 7 or 10 years, then adjusts each subsequent year.

TD Bank home equity loans are only available in about 16 states. Borrow from your home's equity to finance your next home renovation or purchase. No pre-payment penalties – There are no penalties to pay off your mortgage early.

New Auto - Up to 66 Months

There are closing costs, however, which can range from $175 to $2,000. TD Bank has among the lowest interest rates that are not just an initial teaser rate—it’s for the life of the loan. The 4.49% starting APR is specifically for its 10-year home equity loan. However, you’ll need a high credit score to qualify for that lowest rate. Additionally,TD’s home equity loans aren’t available in all states.

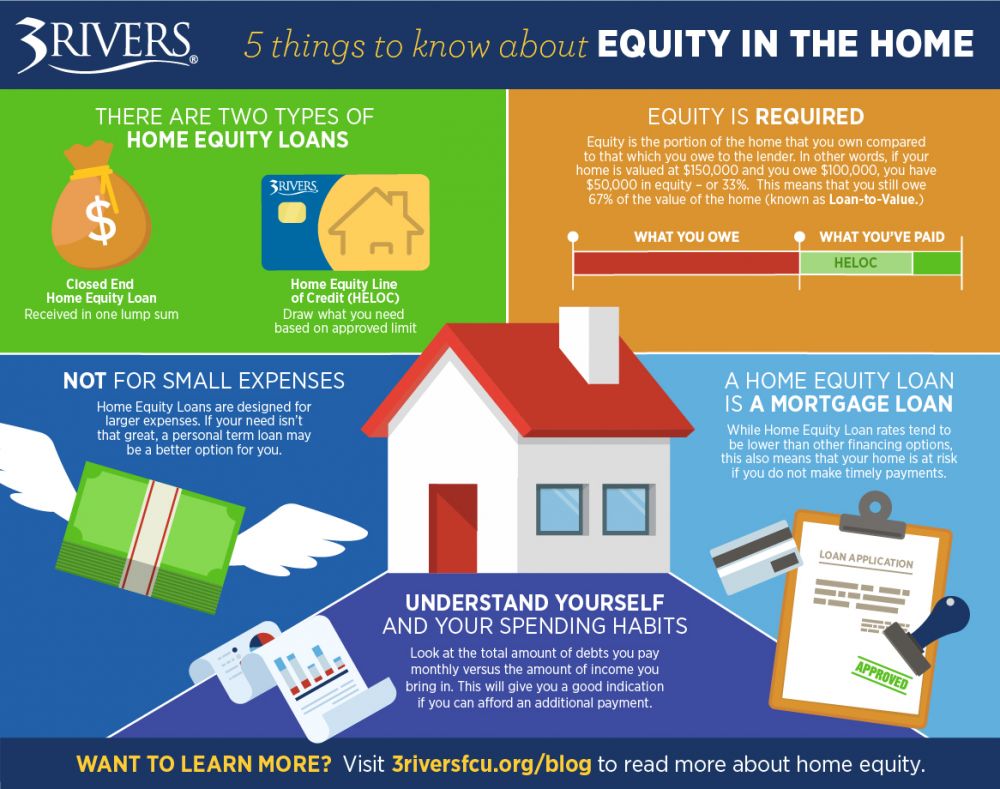

Lenders are currently offering rates that start as low as 5% to 6% for borrowers with good credit, but rates can vary depending on your personal financial situation. Most lenders will allow you to borrow anywhere from 15% to 20% of your home's available equity. To calculate your home equity, subtract your remaining mortgage balance from the current appraised value of your home. How much equity a bank or lender will let you take out depends on a number of additional factors such as your credit score, income and DTI ratio.

How to apply for a home equity loan

For example, if your home is worth $450,000 and you owe $250,000 on your loan, you would refinance for the entire $450,000, rather than the amount you owe on your mortgage. Your new cash-out refinance home loan would replace your existing mortgage, and then offer you a portion of the equity you built (in this case $200,000) as a cash payout. Marc is senior editor at CNET Money, overseeing banking and home equity coverage. He's been a financial writer and editor for more than two decades, working for The Kiplinger Washington Editors, U.S. News & World Report, Bankrate and Dow Jones.

Miles required are the “starting from” rates for round-trip travel in economy class per traveller. Most recent NOAmay be requested to show no income tax owing – If income tax owing it will need to be paid out from the new home equity loan upon closing. Monthly service fees do not apply to primary account owners less than 21 years of age. Early withdrawals on Certificates are subject to penalty. Citadel will impose a penalty if you withdraw any of the funds before the maturity date. Manage your loan and stay current on statements, payments, and more with personalized alerts and reminders.

Homebuyer Terms to Know

“Instant Approval, Conditional Approval, Pre-Approval” – Borrower subject to credit and underwriting approval. Not all borrowers will be approved for conventional financing or equity financing. Receipt of the borrower’s application does not represent an approval for financing or interest rate guarantee. Restrictions may apply; Annual APR is subject to approval and underwriting; APR includes all fees and rates calculated on a yearly term. APR varies; contact us for current rates or more information on a specific product.

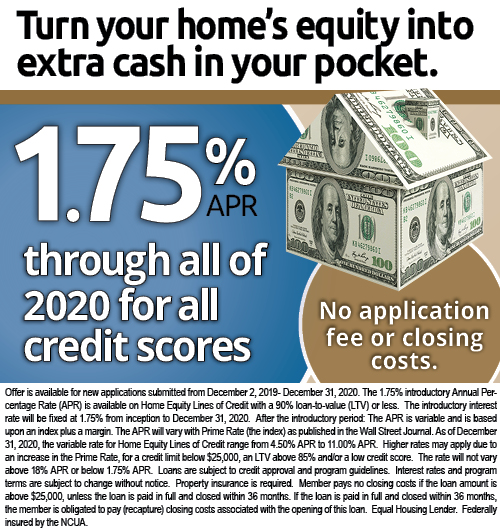

• A 10/1 ARM has a fixed interest rate until the 120th month and can change every 12 months after. • A 7/1 ARM has a fixed interest rate until the 84th month and can change every 12 months after. Home equity line of credit APR is established using The Wall Street Journal Prime Rate 10 days prior to the end of the month and changes on the first of the following month. You can also use a home equity loan in the event of an emergency like unplanned medical expenses. If you can't pay back the loan, the lender can seize your home to repay your debt.

Free pre-approval – Get your financing approved before you buy, so you know exactly how much you can spend. We calculate all early withdrawal penalties on the principal amount withdrawn at the dividend rate in effect on the account on the withdrawal date. If your account has not earned enough dividends to cover an early withdrawal penalty, we deduct any dividends first and take the remainder of the penalty from your principal.

You also want to make sure that your repayment term is long enough for you to comfortably afford the monthly payments. The shorter your loan term, the higher your monthly payments are likely to be. Home equity loans are often a better option if you know the amount you need already—say for a child’s education or a home construction project.

Andrea Riquier is a New York-based writer covering mortgages and the housing market for Forbes Advisor. She was previously at Dow Jones MarketWatch, on the housing market and financial markets beats. Before that, she covered macro and central banks for Investor's Business Daily, and municipal bonds for Debtwire. Forbes Advisor adheres to strict editorial integrity standards.

For loans up to $250,000, closing costs are typically between $300 and $2,000. Starting APRs are based on borrowers having the best credit profiles and applying for an LTV of 80% or less. It also includes a 0.25% initial rate discount when a borrower sets up automatic payment from an Old National checking account. Our ratings take into account interest rates, lender fees, loan types, discounts, accessibility, borrower requirements and other attributes. All ratings are determined solely by our editorial team. Fee does not apply to primary account owners less than 13 years of age.

When it comes to saving wisely and investing for your future, Citadel has plenty of great options to help you reach your goals.

No comments:

Post a Comment