Table of Content

Homeowner’s insurance is designed to protect you and your belongings, including your garage. Using quiet opener lubricant to apply oil where moving parts meet helps slow them down and creates less noise when you open and close your home insurance garage door. Use wax lube only if your operator recommends it; stick with a silicone spray lubricant.

Other structures coverage typically has a coverage limit of up to 10% of your dwelling coverage. Assuming that your policy does cover the garage door, there are still a few things to keep in mind. For example, most policies only cover damage that is caused by events that are out of your control. So, if your garage door is damaged by a fire or a storm, your insurance will likely cover the repairs.

WILL HOME INSURANCE POLICY COVER A BROKEN GARAGE DOOR?

However, you should check your car insurance; your liability insurance may cover the damage to your vehicle. When it comes to homeowner’s insurance coverage, severe weather can be problematic. If your garage door is damaged by hail or wind-blown debris, your insurance company will most likely cover some of the repair costs.

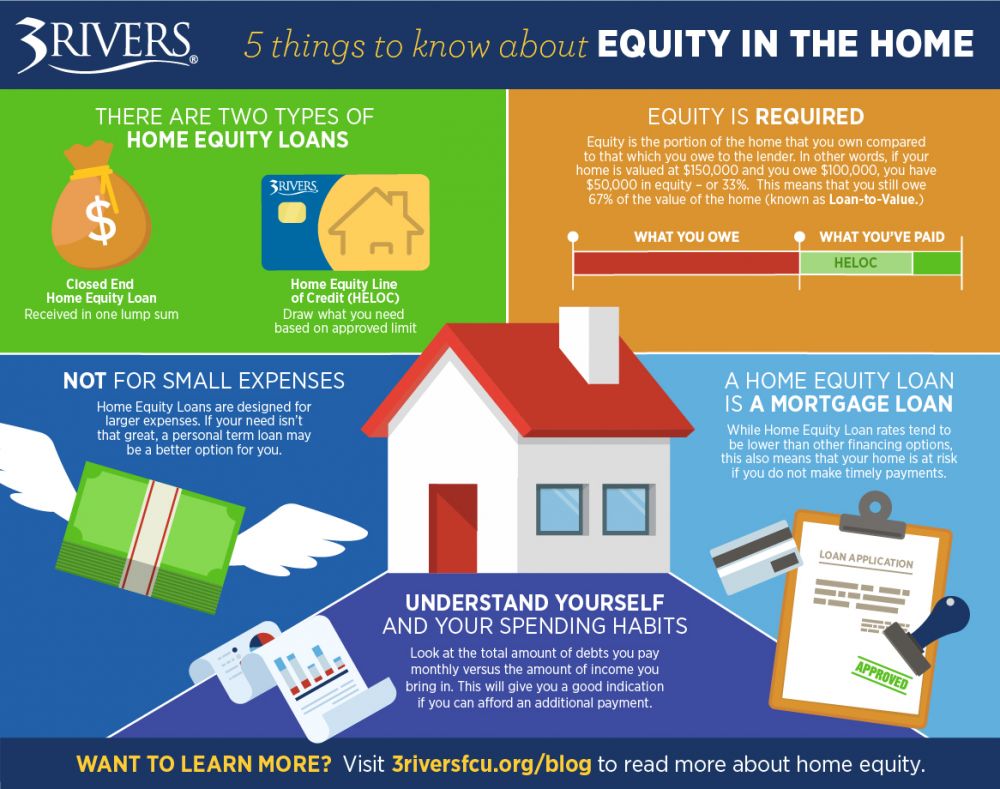

In some cases, a detached garage will be covered by your home insurance under an “other structures” policy. These policies offer protection for fences, pools, sheds and even garages that are not technically part of the home. However, it is typically covered by a lower percentage compared to the rest of your house.

Some home insurance policies do not cover the garage door.

Additionally, if the repairs only cost slightly more than your deductible, and you can easily afford them, it may not be worth submitting a claim. Home insurance provides a wide range of protections for property owners. It's there to help you when sudden, accidental incidents happen that leave you with a significant amount of damage to repair. In some cases, it can help you to make repairs or even replace your garage door, depending on what caused the garage door problem in the first place. The first step is to check your insurance policy to make sure you know what it covers.

The cost of a new garage door, as well as repairs to the rest of your house, is likely to be covered by insurance. Studying your policy thoroughly is crucial because certain things you might assume are covered aren’t! If a natural disaster damages your garage door, such as an earthquake or flood, you may be responsible for the repairs. The best course of action is to review your insurance to determine what is covered. Although it is not required for home insurance to cover a garage door, you may want to consider installing access control anyway.

Vandalism and Break-Ins

This consists of things like graffiti and other criminal damage, specifically scarier circumstances such as break-ins. Check with your insurance agent a damaged door may be covered. But there are still some instances where your insurance will hold you responsible for covering the cost.

However, the total amount of coverage for your garage depends on whether it’s attached to the rest of your home or not. Housefires can be devastating, but having insurance can provide comfort knowing it can cover the damages and replace most of your property. Insurance will likely cover a replacement garage door along with repairs to the rest of your home. Garage doors protect a large entryway into your house and all of the possessions you store inside your garage. If a driver in training accidentally backs into your door or a tree lands on your garage during a hurricane, you’ll want to make repairs right away. It’s important to understand what’s covered by your garage insurance policy to help you make affordable repairs if disaster strikes.

Home Insurance Door Replacement

The same goes for thieves who attempt to enter through a garage door and cause structural damage and theft; there may be covered here. Specific sorts of occasions might be covered by your home owners insurance coverage. When it comes to an crash that was completely out of your control, like a hit-and-run, tornado or criminal damage, you can sue and also get some aid fixing the damages.

In most cases, your garage is considered part of your home and may be covered. Each insurance policy differs slightly, so some damages may be covered while others may not. It’s important to focus on the aspects you can control, like investing in a quality garage door that will hold up well to the elements.

It is violating when someone intentionally damages your property. Fortunately, malicious activity is often covered by a homeowners policy. If a stranger vandalizes your garage door with spray paint or a baseball bat, insurance often pays for the repairs.

However, you should check your automobile insurance; your liability insurance may cover the damage to your vehicle. Since normal homeowners insurance covers the house and everything linked to it, an attached garage is also covered. It considers the section of your house that connects to the rest of your house, such as a chimney or a balcony off your bedroom. As many people drive their cars into their garages every day, they need a sturdy set of garage doors to protect them from injury or harm while inside.

If you’re not sure, you can always contact your insurance company and ask. There are some factors that go into whether your homeowners insurance will cover repairs for your garage door. It’s important to go over your policy to understand what your insurance covers and what it does not.